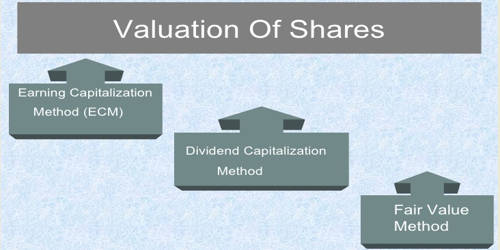

Explain Different Methods of Valuation of Shares

The Gordon model assumes that a. Methods of valuation net assets value nav method intrinsic value of share net assets of company total no.

Basic Valuation Model Investment Valuation Bbalectures Com Basic Business Articles Investing

These methods can either find the absolute value of a stock or the stocks relative value.

. Of shares where net assets net assets equity share capital. 1 Absolute valuation Absolute valuation models find the fair value also known as its intrinsic. Net Assets Method Of Valuation Of Shares Under this method the net value of assets of the company are divided by the number of.

Under Yield-Basis method valuation of shares is made on i Profit Basis. There are different methods that can be used to value shares. Absolute Valuation Absolute valuation models attempt to find the intrinsic.

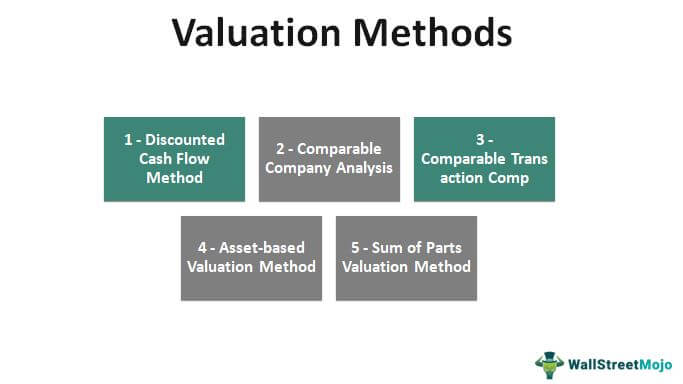

What are the Main Valuation Methods. For instance the Gordon model is one of the most commonly used in stock valuation. Absolute valuation and relative valuation.

Book value means the net worth of the company. It is the net worth of a company divided by. ETRADE helps make it simple.

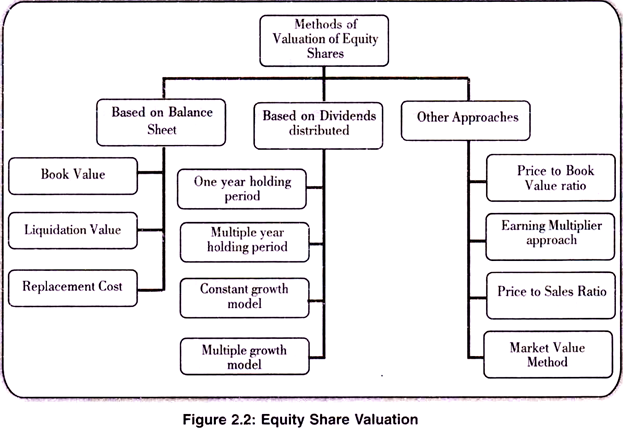

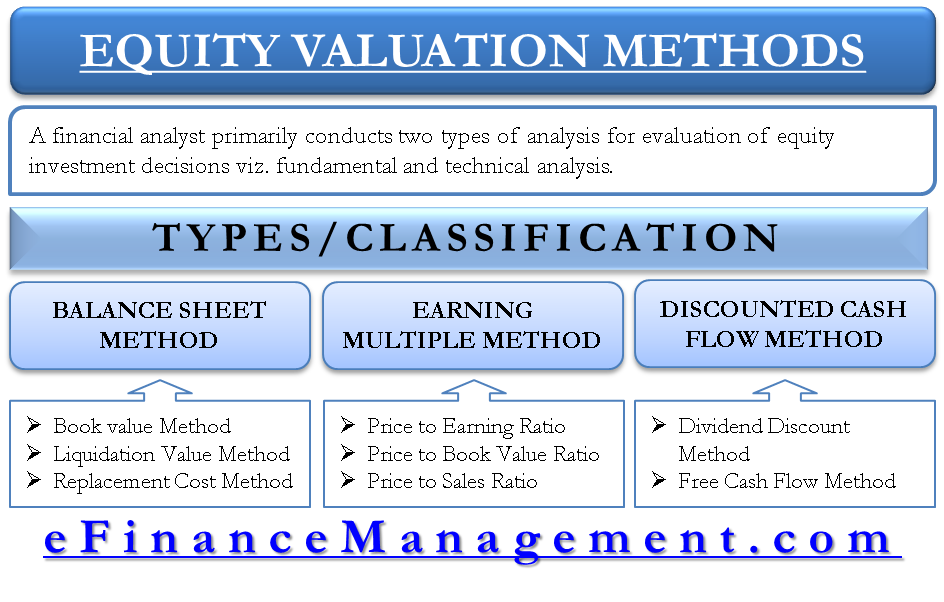

Generally there are three methods of valuation of shares. In this method book value as per the balance sheet is considered the value of equity. Comparable Analysis Comps Method 2.

Ad 6-Time Award Winning Trading Software. Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. The Guideline Public Company Method which uses the prices of similar companies publicly traded.

Ad How To Trade Options will change how you invest your money - receive it today. Generally there are three methods of valuation of shares. Ad Seek companies with potential for sustainable business practices and positive impact.

Another method of valuing shares is based on earning per share EPS or net profit per equity share multiplied by the price earning ratio PE Ratio. Two of the significant methods of valuation under the market approach are. Based on Balance Sheet.

Following are the most common methods used for equity valuation. Under this method at first profit should be ascertained on the basis of past. Valuation methods typically fall into two main categories.

Net Assets Method Of Valuation Of Shares Under this method the net value of assets of the company are divided by. The PE Ratio is really the converse of the. Types of Stock Valuation.

Stock valuation methods can. Elevate Your Trading - Try Free Now. Precedent Transactions Method 3.

Ad Investing doesnt have to be complicated. Net worth is calculated as follows. Sustainable investing seeks to invest in companies that are thriving.

Additionally an investor should know about major stock valuation methods and the scenarios in which such methods are applicable.

Financial Accounting Ii Old Scheme 2nd Year B Com 2014 7 Of 15 Question Paper Financial Accounting Accounting

What Is Stock Valuation Valuation Master Class

Welcome To The Stock Market Update Blog Our Mission Is To Bring Readers Helpful Information That Is Worth Capi Stock Market Value Stocks Accounting Principles

Difference Between Primary Market And Secondary Market Secondary Market Secondary Marketing

Valuation Of Equity Shares 3 Methods Securities Financial Management

Methods Of Valuation Of Shares Assignment Point

Equity Valuation Methods Types Balance Sheet Dcf Earnings Multiplier

Fundraising Structure Fundraising Strategies Raising Capital Fundraising

Term Structure Of Interest Rates Theories Bbalectures Interest Rates Business Articles Finance

How To Calculate The True Value Of The Property What Are The Methods To Realestate Valuations Am Real Estate Tips Property Marketing Real Estate Investing

Merchant Bank Overview Functions And Working Principle Merchant Bank Business Valuation Financial Strategies

Options Finance Types Call Options And Put Options Bbalectures Finance Put Option Call Option

Valuation Methods Three Main Approaches To Value A Business

Valuation Of Shares Net Asset Method Yield Method And Fair Value By Kauserwise Youtube

Stock Valuation Overview Types And Popular Methods

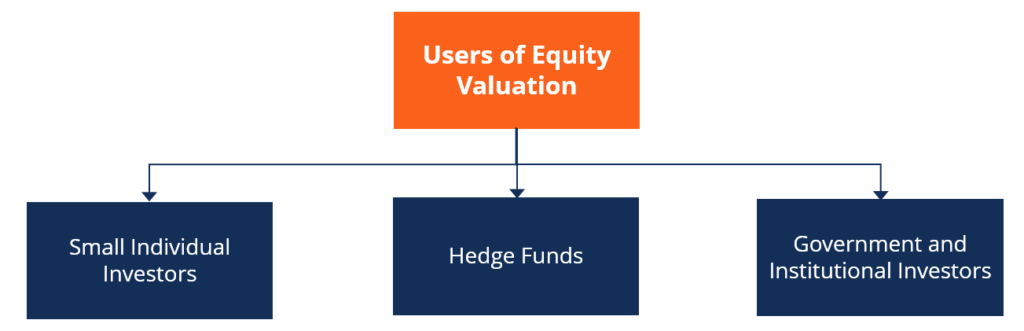

Equity Valuation Overview Types Of Users And Process

How To Find Intrinsic Value Of Stocks Using Graham Formula Trade Brains Value Stocks Investment Analysis Intrinsic Value

Valuation Methods Guide To Top 5 Equity Valuation Models

How To Analyze Stocks Fundamental Vs Technical Analysis Stock Analysis Investment Analysis Financial Analysis

Comments

Post a Comment